Awards April 01, 2019

65 Ways the Promo Products Industry Has Changed

The promo world is a lot different today than it was when Counselor was first published. Here are some of the biggest shifts we’ve seen.

65 Years of Counselor: Get more coverage here!

When ASI founder Joe Segel first estimated industry sales, he pegged them at $459 million. Today, distributor sales are $24.7 billion.

Money from PE investors is pouring into promo like never before. Top 40 firms like HALO Branded Solutions (asi/356000), alphabroder (asi/34063), Polyconcept North America and Zorch (asi/366078) are just some of the industry companies with strong PE backing.

The fax machine changed business communication and sped up order processing, but was eventually replaced by digital tech – allowing for “electronic art transfer” of clients’ logos. Fast forward to 2019 when about 53% of distributors with sales of $5 million or greater now place orders through a website or software program.

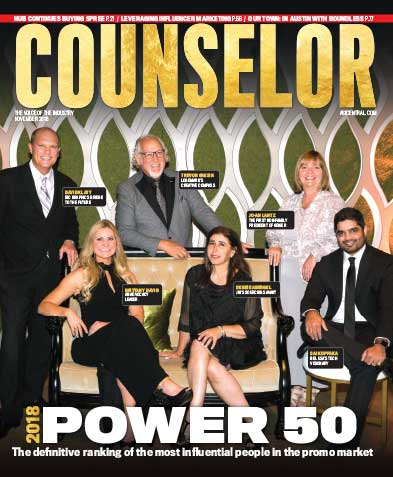

The number of women prospering in promo has risen sharply. “Some of the women pioneers were Betty Wolfe, Margaret Custer Ford, Lorraine Hempen and Martha Sanders Gennett,” says H. Wayne Roberts, the retired VP of Pioneer Balloon (asi/78200). In recent decades, even more women have broken through the glass ceiling to hold pivotal leadership roles. The 2018 Counselor Power 50 list featured 15 women, the highest total ever. “When I started in this industry in 1997, I worked for a Top 40 supplier and it was male salespeople for the most part with 20-something female assistants,” says Heather Comerford, CEO of 1338Tryon (asi/287946). “Now I run a business.”

The promo industry has become more diverse – ethnically and racially – after existing for decades as almost exclusively a white man’s profession. Better education and industry-wide internship programs are helping the promo market appeal to more groups.

Segel remembers that, back in the 1950s, a select number of large companies controlled much of the industry. But ASI, he says, played a key role in opening up the market so that mom-and-pop distributors and suppliers could form, connect, compete and win business. Now, there are more than 20,000 distributor members and thousands of suppliers. “ASI upset the applecart,” says Segel.

Despite promo still being home to many small businesses, consolidation has accelerated within the past decade – a result, in part, of increased M&A activity. Bigger firms on both the supplier and distributor side have been buying smaller companies to gain market share, augment their capabilities and expand geographic footprints.

Once upon a time, most suppliers tended to specialize in a single line of products, like pens. Now, many firms – the recently formed HUB Promotional Group (asi/61966), for instance – are expanding into a variety of categories, with large suppliers in particular aiming to be a one-stop-shop.

Distributors are trying to be more of a total solution for customers too, adding services to capture as much of each client’s spend as possible.

Web-based, industry-specific databases like ASI’s ESP have emerged to help distributors source seemingly over a million products from their computers and mobile devices.

As recently as the late 1970s, Ira Neaman recalls, apparel was hardly a blip on the industry’s radar. “Now,” says the president of Top 40 supplier Vantage Apparel (asi/93390), “it accounts for more than a third of industry sales. Everything from the rise of corporate casual culture to a growing desire among end-clients to have their people in branded gear has accelerated apparel’s ascent.”

Another factor that’s the industry’s gain: More retail brands and styles are available in promo than ever before.

Industry buying groups have formed, drawing praise and criticism. Positives, advocates say, include that they help smaller firms compete, allow for sharing of best practices and help ensure supply chain reliability. Among the negatives, critics maintain, is that they unfairly freeze out certain suppliers, reducing competition.

Geography isn’t a restriction like it used to be in promo sales. Today, “distributors can handle local and national orders in a matter of minutes, and customers are seldom seen in person,” says Walter Hill Jr., president/CEO of LA-based Icon Blue, powered by Promo Shop (asi/229398).

Email exploded into the business world in the 1990s, massively revolutionizing the ordering process. “I remember when I started in the industry, and the packs of Purolator or UPS envelopes would be stacked at our back door around closing time containing orders, artwork, disks, etc.,” says industry veteran Steve Polish, vice president at TNM Promotions. “We had to make special deals with drivers on when to pick up these envelopes. Now everything is done via email.”

Turnaround times have quickened to a pace that was unheard of at the turn of the century – much less in 1954. “In most cases, it would take four weeks to complete an order – from initial sale to finished piece in hand,” says Steve Gandolfo of Gando Design (asi/201403). “Now,” adds Polish, “24-hour delivery is common.”

Online video calling/conferencing has burst onto the scene, allowing sales pros to gain valuable facetime with clients and partners while time zones away. “Sitting at my desk Skyping with suppliers around the globe was unimaginable 42 years ago,” says Hill.

The shear breadth of the products available has vastly increased. A push for continual innovation has helped drive this. “Almost every few weeks a new type of product is introduced,” says ASI Chairman Norman Cohn.

As more suppliers enter the market, there are more premiums than there used to be. While many promo products still cost less than $5 each, a search on ESP shows a growing segment of luxury-type pieces, particularly tech-related items.

The industry’s supply chain has gone global. “Thirty years back, most suppliers were manufacturers. Importing from overseas was minimal,” says Paul Lage, president at Top 40 supplier IMAGEN Brands. Now, suppliers import the vast majority of products, primarily from China. That would’ve seemed laughable in days not far in the past when “the quality of overseas product was horrible and China was the least desirable country of all to receive imported product from,” Lage says.

There are now more industry-tied trade shows than ever before. There’s everything from international shows in Hong Kong and Europe, to ASI and PPAI shows featuring high-profile keynoters, to distributor-hosted end-user events at which preferred suppliers display their wares.

Online stores are another outgrowth of the digital transformation of commerce. Distributors can offer customized web stores to clients that range from local schools to large-scale corporate customers. These portals allow a simple, efficient solution for ordering an array of products. “Anyone not offering this is missing the boat,” says Steve Mattero, president of Dezine Line (asi/179939).

While technology has been a boon, it’s also led to significant market disruption. This is seen no more clearly than in the emergence – and eye-popping success – of certain distributors that base their business model entirely, or almost entirely, on e-commerce transactions. 4imprint (asi/197045), the largest distributor in the industry, perhaps best exemplifies the new reality. In 2018, without a traditional sales force, the firm tallied worldwide sales of $738.4 million. 4imprint earned the vast majority of that revenue in North America.

Supply chains have globalized, and sales efforts are starting to as well. A growing number of North American distributors – and select suppliers – are expanding into international markets through acquisition, partnership and/or establishing in-house offices overseas. More U.K. distributors are setting up shop in the U.S. too.

In the 2000s, polyester became an “it” fabric, opening the door to more enhanced “performance” innovations like advanced moisture wicking.

Fabric has continued to evolve, with creative designers/manufacturers blending natural and synthetics into fashion-forward creations.

Sublimation printing has allowed full-color prints to cover garments, thanks to new tech. Graphics are fused into the fabric, making for a virtually indestructible logo.

Similarly, direct-to-garment digital printing has come to the market. The inkjet technology is capable of printing elaborate full-color designs directly on garments. It presents an opportunity to offer cost-effective one-off and small-batch printed apparel runs.

“Athleisure” wear has arrived in force. The trend has benefitted the promo industry, with end-buyers eager for apparel that works equally well when worn on a brisk morning jog or in the office.

Both traditional embroidery and screen-printing has improved significantly over the years. The creative, attractive prints and stitched looks have bettered logoed apparel’s appeal.

The speed of decorating fulfillment has increased. “A generation ago, it took three weeks to get a one-color not-good-looking piece, and now it’s a day or two for high-quality multicolor,” says Craig Nadel, president of Top 40 distributor Jack Nadel International (asi/279600).

Because of the online availability of products, end-buyers are able to rapidly review a broad selection of products and compare prices. Reps, and to a lesser extent catalogs, are no longer the source of pricing.

With the advent of Amazon and Walmart Promo Shop, competitive threats are much different. Distributors must vie for marketing budget dollars with new media as well, like social media and internet advertising.

“Distributor sales reps used to be thought of as product peddlers; now they’re considered consultants, helping their clients grow their business through careful and thoughtful ideas and promotional programs,” says David Rones, president of PromoMatting by Americo (asi/35750).

While the traditional supplier-distributor-end-buyer model remains dominant in the market, execs say promo firms “going direct” is more common than ever. Certain suppliers sell directly to end-clients, while some distributors source product directly from overseas manufacturers.

Distributor sales pros have had to become more versatile and flexible in their communication with clients. Some customers still like to meet in person and/or talk on the phone. Others, especially younger buyers, want to do everything through email and text.

Social media has turned traditional marketing on its head. Brands are devoting ever-more resources to using blogs and social platforms to attract and engage customers through organic means and paid ads.

Web-based video has become a powerful tool that both distributors and suppliers use to market themselves – part of a broader sea-change in which many firms have evolved into their own media producers. As an example, Michael Levy, president of Compass Industries (asi/46170), says distributors “come up and say they saw me or a new product in a video, say thanks and ask that we continue sending the videos.”

These days, even small promo firms really need a website – or at least a business page on a social media platform like Facebook.

In the latter half of the 20th century, do you think anyone in the industry could’ve envisioned having to worry about search engine optimization? And yet, SEO is a top concern for many industry firms as they compete for high rankings on Google.

The cost of doing business has gone up. That, in part, is a consequence of having to invest in the technology that’s necessary to be relevant and secure today. Still, ASI data shows 55% of distributors increased their profits in 2017, demonstrating the health of the market.

A rising number of industry firms have started focusing on how they impact the environment and have taken steps to operate more sustainably. HanesBrands (asi/59528), for instance, has earned praise for its efforts to reduce energy consumption and carbon emissions by 40% by 2020 over its 2007 benchmark. Geiger (asi/202900), meanwhile, has installed a solar power system at its Lewiston, ME, headquarters – the largest of its kind for a business in its state.

Corporate social responsibility has come sharply into focus for promo firms, too. From increased volunteerism to donating to worthy causes, companies are stepping up their commitment to giving back and doing right. In one example, distributorship Authentically American (asi/127625) contributes 10% of topline revenue to nonprofits that assist military veterans, first responders and their families.

Suits and ties used to be de rigueur for industry sales professionals and executives. While they haven’t gone away, corporate casual has become the norm.

Smoking has been extinguished. It used to be commonplace inside conference rooms at business meetings and on the floor of industry trade shows. Light up inside at an event now, and you’re going to get a tap on the shoulder from security.

The relationship between the promo products and incentives industries has changed. “Back in the early 1980s, promotional products distributors were looked down on by the incentive market as sellers of trinkets,” says Roberts. But today, there’s a “good, mutually beneficial working relationship between many distributors and incentive suppliers.” Indeed, some distributors are making strong inroads into the incentives market. In 2017, HALO acquired leading incentives firm Michael C. Fina Recognition and rebranded it as HALO Recognition.

Visionary Paul C. Fisher created an incredible pen – the first of its kind – that astronauts could write with in space. The “Space Pen’s” first mission among the stars was in 1968. Today, astronauts still use the pens, and Fisher’s family runs supplier Fisher Space Pen (asi/54423), selling to the promotional products industry.

Quality education programs and certifications for promo professionals have become widely available. “Expanded, informed and broader-thinking industry education has made us more diligent and professional,” says Marsha Londe, the CEO of industry consultancy Tango Partners.

As knowledge about potentially dangerous chemicals has increased, so have regulations intended to protect end-users, like Prop 65. Ensuring products comply with all safety rules and regulations has become a key focus for suppliers.

Given today’s global supply chain, it’s incumbent on industry firms sourcing from overseas manufacturers to make certain products are being made by workers laboring in humane conditions. Failure to do so could be disastrous, as experience has shown that end-clients will swiftly abandon companies connected to manufacturers tied to human/labor rights scandals.

For many years the pharmaceutical market was the largest in terms of distributor sales. That changed in 2009 when the pharmaceutical industry’s trade association banned the distribution of “non-educational items” to healthcare professionals. Today, the education market is consistently promo’s top sector.

Requests for Proposals (RFPs) are more common, presenting both challenges and opportunities. “Procurement views promotional products as commodities with a lowest-price objective,” says Londe. “We must educate purchasing managers about ‘total cost,’ ROI and logoed products’ effectiveness as a marketing medium.”

Distributors still cold-call over the phone and by walking into businesses to strike up relationships. Still, the general consensus among promo pros is that these methods aren’t as effective. Indeed, ASI research shows only 25% of distributors say cold-calling helps them win deals, a dramatic drop from decades earlier.

Smartphones, laptops and tablets have helped spawn all-new tech-related brandable products, from power banks to phone cases to messenger bags with laptop compartments. Wearable tech options are also increasing, albeit slower.

In the digital age, it’s become more difficult for industry professionals to disconnect from work, with round-the-clock efforts not uncommon among hustlers. These days, “always on” isn’t much of an exaggeration.

While industry award competitions officially got their start in the late 1950s, the annual Counselor banquet has taken recognition to a new level. The industry’s most exclusive formal event as some call it, the banquet features Top 40 unveilings and video tributes. About 20 years ago, it was common for the banquet to run well after midnight. Today, the late night crowd instead attends various after parties, some sponsored.

Customer Resource Management (CRM) software has emerged to help companies better manage pipelines – and maximize returns.

As health insurance costs have skyrocketed, corporate wellness programs have come into play to help employees be healthier, happier and more productive. The trend has given industry firms a new market to target.

Legal cannabis is coming to the fore as a legitimate market for distributors to sell into. That probably would’ve been unthinkable to most professionals in the 1950s.

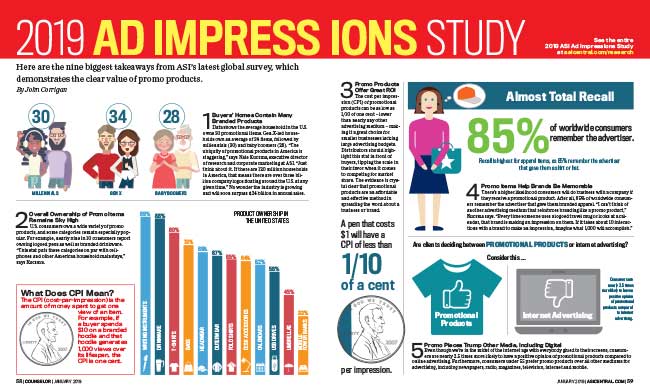

Data is becoming more important in marketing decisions, making surveys and reports like the Counselor State of the Industry, Ad Impressions Study and Advantages Compensation Survey even more sought after.

Speaking of compensation, which used to be all commission, more distributors are moving toward a hybrid model. Reps are increasingly being paid a salary and a commission.

The industry now offers “rapidly advancing end-to-end e-commerce solutions for nearly all participants down to end-buyer clients,” says Chris Vernon, president/CEO of Top 40 distributor The Vernon Co. (asi/351700). In fact, ASI data shows about half of distributors used the web to sell promo products in 2018.

The music industry embraced branded merchandise with items like concert T-shirts in the 1970s. Now, musical artists have greatly expanded their merch offerings, launching everything from custom products to capsule apparel collections to generate revenue in the wake of declining sales of traditional albums/CDs.

Sales pros have had to polish up their writing skills as they create social profiles on sites like LinkedIn to sell and author blogs to position themselves as experts.

Counselor has changed with the times too, evolving from a print publication into a multimedia resource. While the monthly magazine remains a primary focus, staffers are creating articles, podcasts, videos and the like daily for www.asicentral.com/news and ASI’s social media platforms.